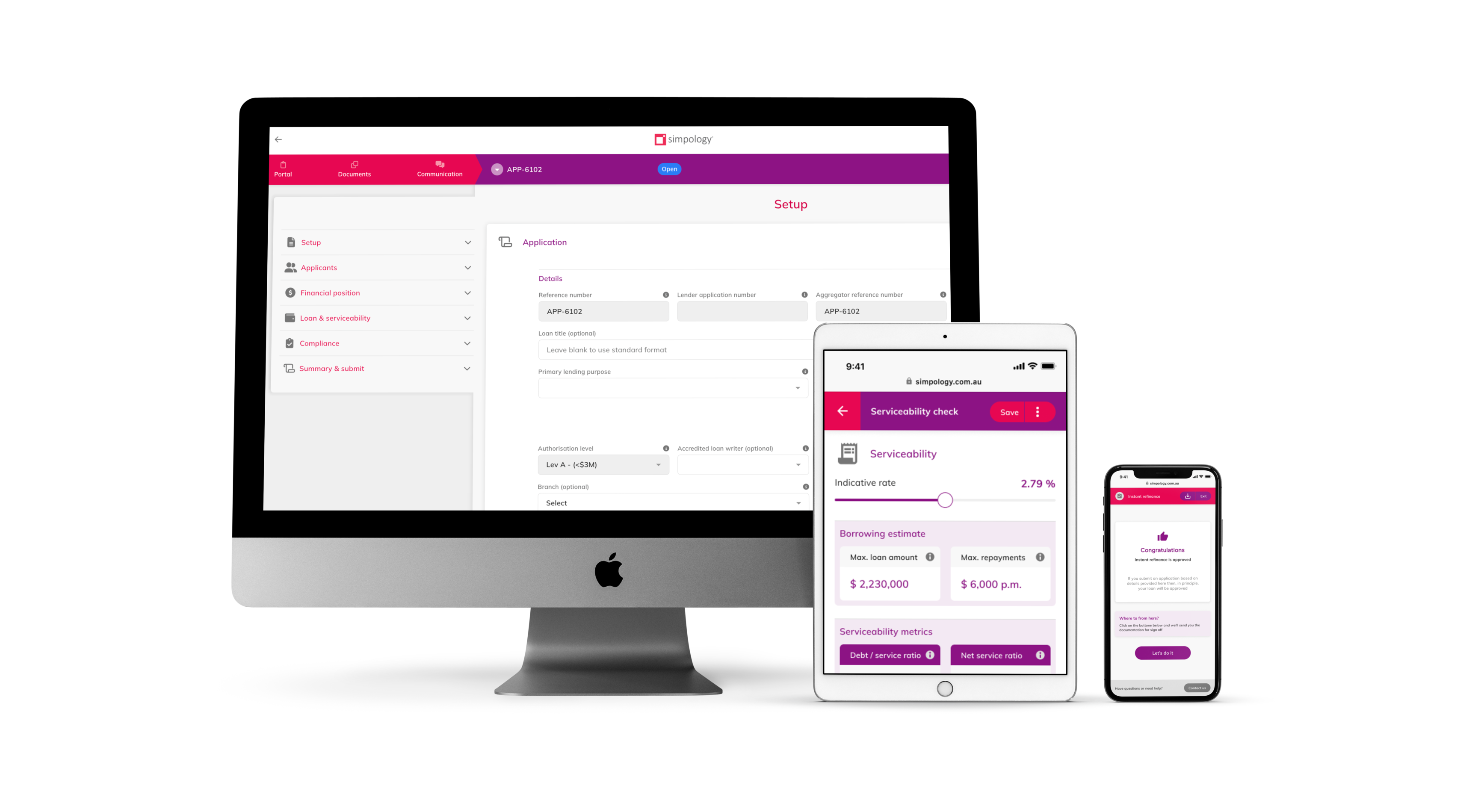

Control data submission quality with a completely configurable loan submission user interface.

Configure with:

The Simpology ecosystem allows you to build the application journeys yourself and self-manage the configuration as requirements change.

Use our branding engine to manage colour palettes, logos, fonts, button styles, footers and backgrounds.

Use our configuration engine to configure the Loanapp experience yourself - everything from the data set to digital services.

Configure engines to power your experience, dynamically managing your logic and user interactions to ensure correct and valid applications.

All engines can be updated and republished at any time:

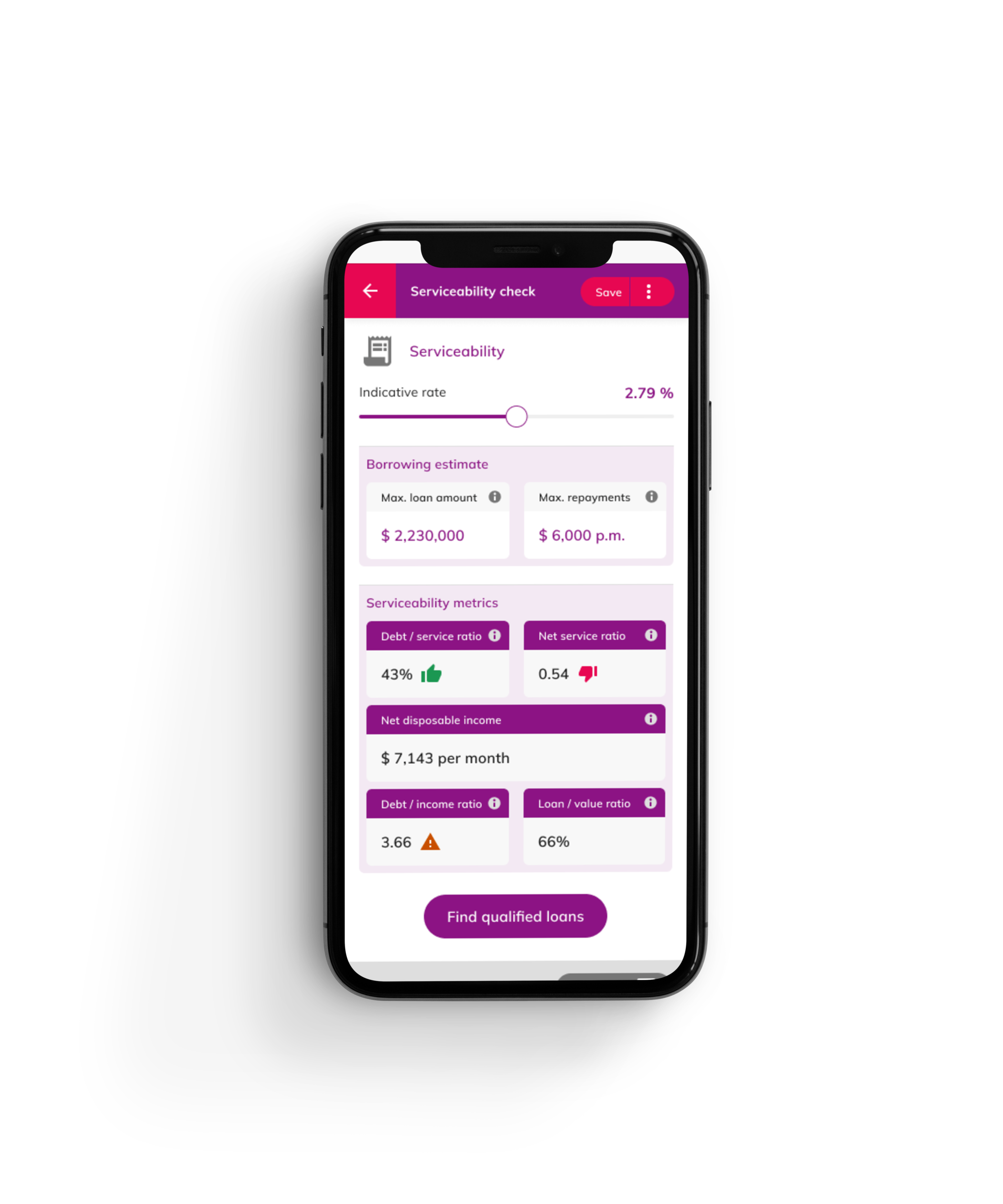

Digitise your application experience to make things easier for your users, and also to deliver qualified credit-critical data to your assessment workflows.

Use digital services to auto-populate workflows, validate collected data, or devise workflows to have point of sale comparison of declared vs digital data.

Tap into Open Banking, Bureau services, AVM data, Fraud services, your own data/engines; and more.

Supports all application types - company, trust, SMSF, construction, bridging, self-employed, foreign income.

Configure compliance requirements, and ensure the correct Point of Sale questions are asked and answered, with suitability ascertained.

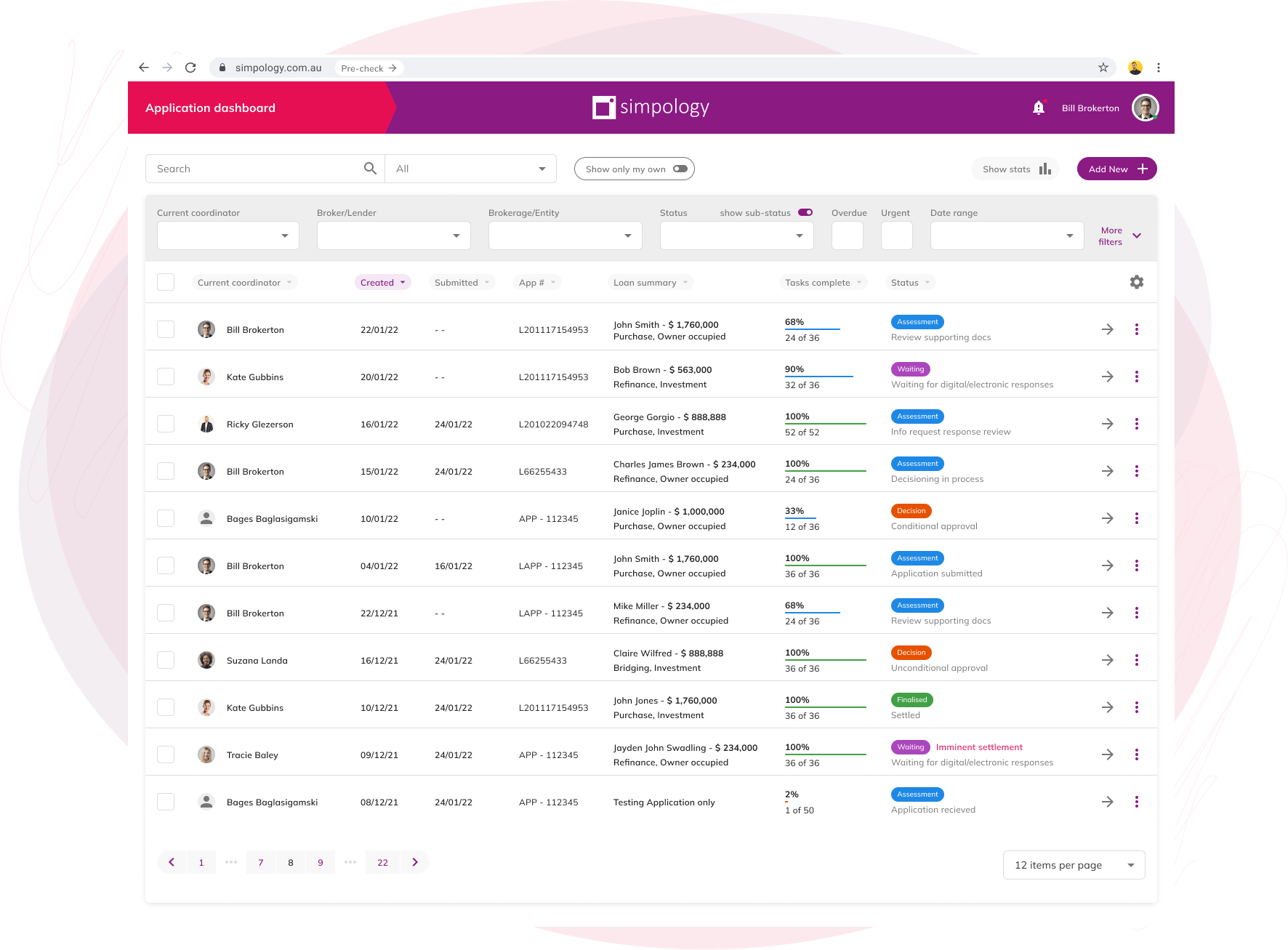

Application dashboard provides convenient overview of a partner’s applications, with filtering, statuses, alerts and access to applications and tasks such as missing information requests.

With configurable roles and permissions, you are able to manage visibility of pipeline within your teams, BDMs, and origination partners.

Your Loanapp can become an integral part of your overall origination ecosystem - with many roles:

Empower your customers and network to interact intelligently and conveniently with your sales and operations teams.

Control interactions with clear and concise data capture, logic and requirements.

Delight customers with easy interactions and fast outcomes.

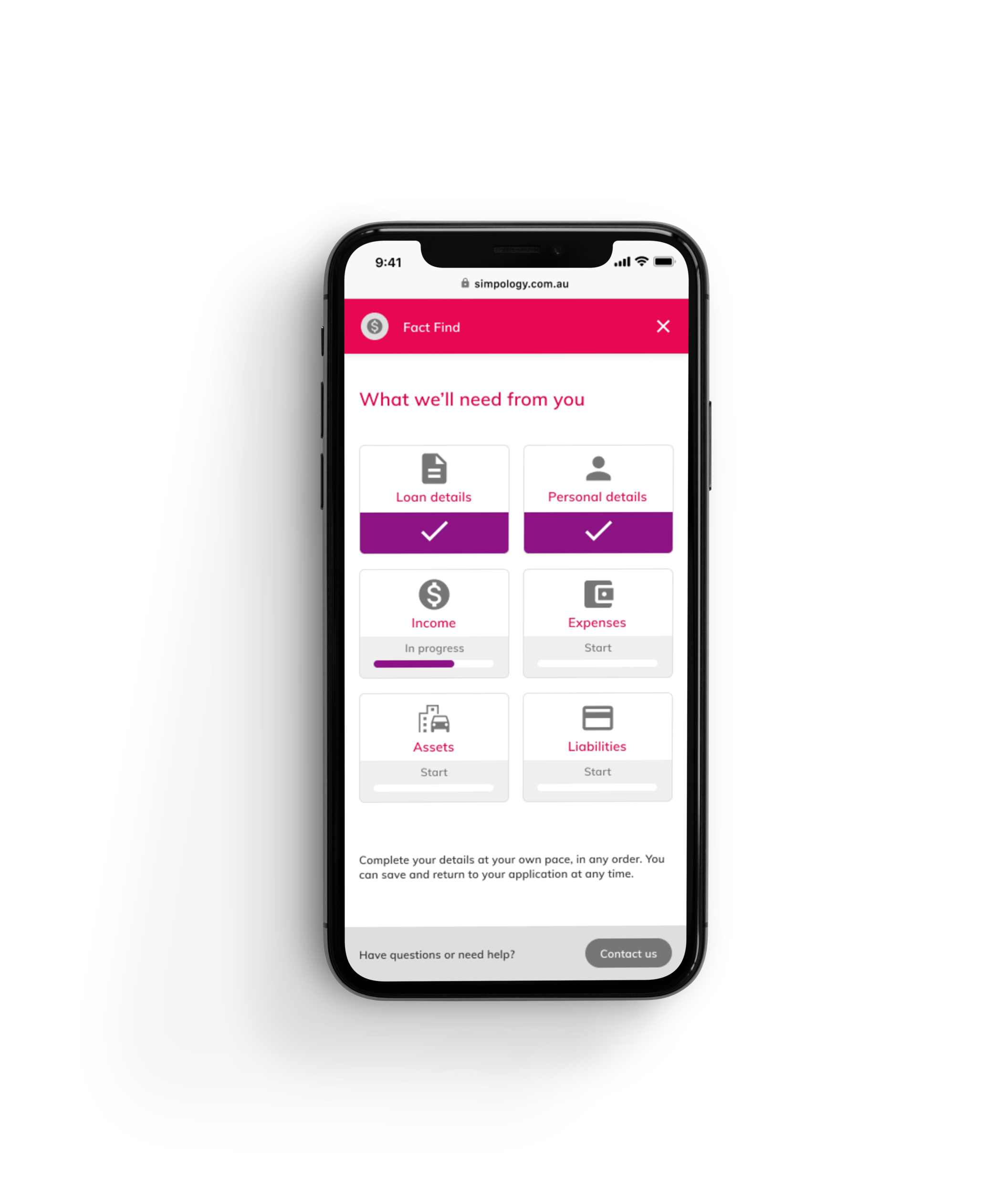

Make available convenient DIY digital workflows to allow your customers – new and existing – to do business with you.

Specific consumer journeys include:

Simpology's journey builder allows you to build any journey to support consumer interactions throughout origination workflows.

Easily brandable and configurable, the Simpology ecosystem will allow you to better equip your teams and service your customers.

Configure decisioning logic to deliver immediate outcomes to consumers.

Build workflows to trigger next steps, allocate submissions and nurture the opportunity.

Why try to fit round opportunities into square holes? Build journeys that are appropriate for the opportunity or requirement at hand.

Refinance journeys, compliance journeys, fact find journeys, variations journeys, compare and select journeys, serviceability and pre-approval journeys, journeys for different credit products, and more. The Simpology journey builder has endless applications.

Consumer DIY journeys can be configured to provide immediate approvals as part of the journey.

However, the Simpology ecosystem has been built to allow DIY submissions to be 'inherited' by first-party (or even broker) networks - so opportunities that cannot completely DIY are not lost and can be nurtured through to fulfilment by your network assets.

with configurable assessment workflows, time-saving integrations, and automated credit decisioning.

Configure settlement and fulfillment workflows, set triggers for integrations to solicitors, title search, and settlement partners.

Receive backchannel and finalisation tasks dynamically, and ensure your network stakeholders, including brokers and customers, are kept engaged and informed.

and configure logic for credit-critical data that can be run automatically to move the application through a configurable decisioning workflow.

Deploy changes to decisioning as policy and markets shift, keeping your team efficient, compliant and confidently making decisions.

Build any number of different collections of logic for different types of opportunities, audiences or workflows.

Manage team performance with configurable SLAs, allocation logic, workflow automation and more.

Use your secure, branded, integrated portals to communicate missing information requests during assessment and fulfillment.

Set tasks for stakeholders, deliver documents and gather consents, and communicate statuses effortlessly via convenient, any-device portal functionality.

Smart tools and convenient interfaces to help your teams complete assessment activities, ensure compliance and quality outcomes.

All workflow requirements and logic are configurable and can be updated and republished as your own risk appetite changes; or in response to market forces.

Simpology is a powerful loan application ecosystem that radically reduces time to decision.