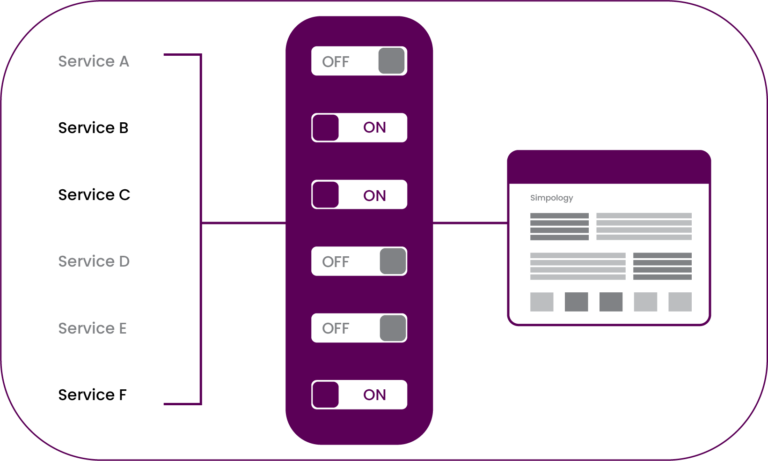

The SSI infrastructure with the Simpology ecosystem allows you to add, remove or swap third party-services without delay or disruption to workflows and existing operations.

Use Simpology digital widgets to embed ready-made, third-party workflows with great user controls over service triggers, re-sets, notifications, reminders and outcomes.